Have room for one more resolution for the New Year? If so, I have a suggestion: Look at the market, and your portfolio, less often. As you will see below, failing to do so likely results in inflated risk aversion and impaired portfolio results. If those highlights aren’t persuasive enough, how about increased risk of a heart attack?

In a classic economic-research paper published by Shlomo Benartzi and Richard Thaler, they highlighted an important finding:

Losing money is 2.5 times as painful as making money is pleasurable.[1]

Nearly all humans feel more pain from loss than pleasure from gain. I call this relationship the “Pain Ratio”. Behavioral economist Matthew Rabin has shown that most people rejected a gambling opportunity that offered a 50% chance of losing $100 and a 50% chance of winning $200[2]. The expected outcome for the gambler is +$50[3], but the perceived pain of a $100 loss stopped most people from accepting even this small-stakes, prudent gamble[4].

What’s your Pain Ratio today? In the above bet, how much would you need to win in order to accept the risk of losing $100? If it’s $150, then your ratio is 1.5. If it’s $300, then your ratio is 3.0. For nearly everyone, the Pain Ratio applicable to an entire portfolio is larger than that on the $100 bet; we obviously need to be more worried about all of our money than a small portion of it.

Aversion to financial loss, or the Pain Ratio, varies from person to person. Those with greater levels of wealth tend to have lower ratios, since they can better absorb losses without altering lifestyle. Those with more income-earning years ahead tend to have lower ratios, since they have time to save and recover losses. And those with calm temperaments tend to have lower ratios, since they better digest disappointing news. (My anecdotal observations would point to temperament as the dominant contributor to one’s Pain Ratio, easily overwhelming wealth and age factors.)

Aversion to loss also varies across time, affected by emotional states and individual circumstances. A lousy night’s sleep probably increases the ratio. A job layoff nearly certainly increases the ratio. A recent stock-market crash tends to increase the ratio substantially.

As Benartzi and Thaler stated, the average person’s Pain Ratio is about 2.5—a surprisingly large number. This magnitude, and the overwhelming pervasiveness of ratios in excess of 1.0, makes clear that human nature is averse to loss, and, in turn, averse to risk.

In aggregate, these natural risk aversions have been helpful. For example, we humans have generally steered clear of lions and tigers and bears. At some point, however, we must take prudent risks and venture out into life’s wilderness. And, somehow, when we do encounter lions, tigers, or bears, we must not let such meetings inflate our sense of their prevalence or their dangers. In my opinion, the best tool for keeping such dangers in perspective is good data.

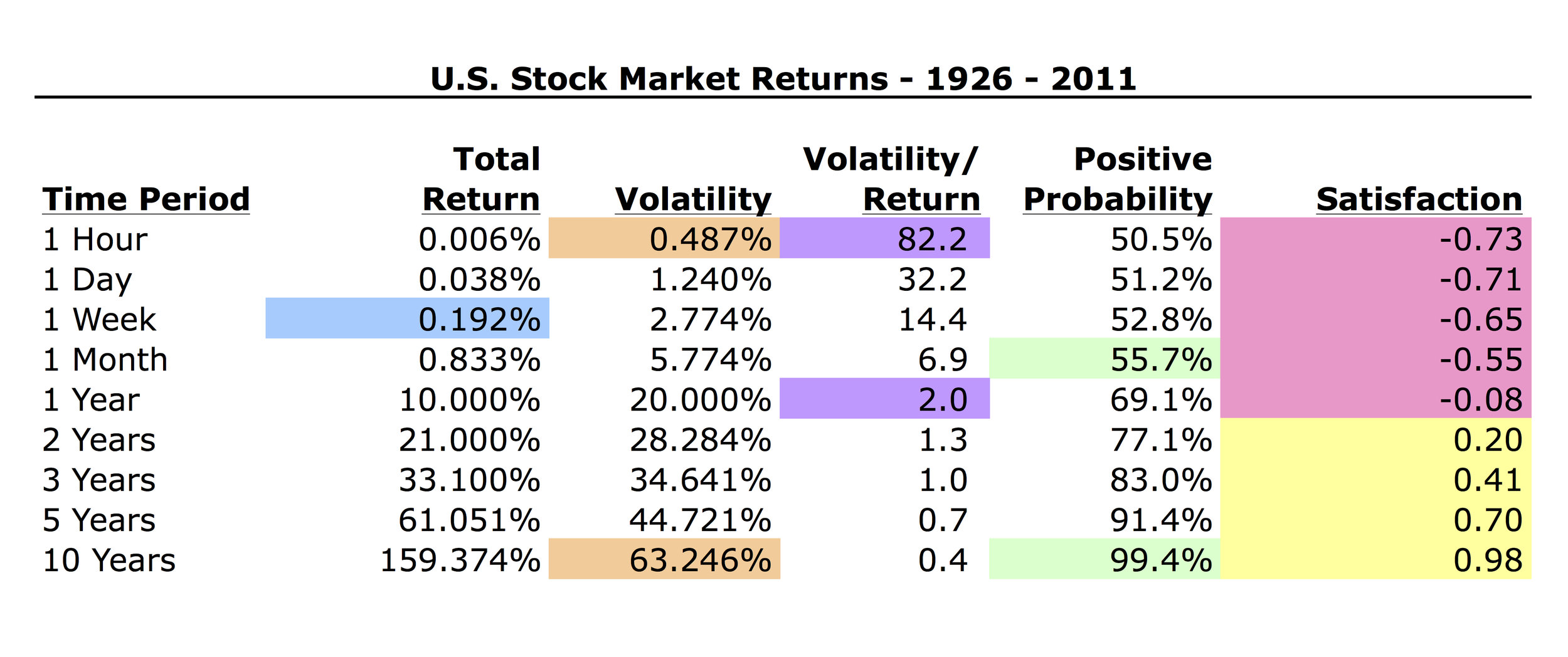

I first observed a table similar to the one below in a paper written by William Bernstein and titled “Of Risk and Myopia”[5]. An updated and modified version of the table below shows U.S. stock market data over various time horizons from 1926 to 2011.[6],[7],[8]

The “Total Return” column displays the average historical stock-market increase over the respective “Time Period”. In the typical week, the return was 0.192% (in blue).

The “Volatility” column shows the standard deviation, or choppiness, of the return. The one-hour volatility was 0.487%, while the ten-year volatility was 63.246% (both in orange).

The “Volatility/Return” column shows the one-hour volatility was 82.2 times the one-hour return[9], while the one-year volatility was just 2.0 times the one-year return (both in purple). In other words, stock-market returns tend to be dramatically more volatile over shorter time periods (on a standardized basis). While this should not be surprising, the degree of the differential is striking.

The “Positive Probability” column displays the probability that the stock market experienced a positive return (i.e., the market went up), on average, over the respective Time Period. In a given month, stocks increased 55.7% of the time, compared with 99.4% in a given decade (both in green).

The “Satisfaction”[10] column attempts to quantify what economists refer to as utility, or usefulness. In this case, Bernstein attempted to quantify the utility derived from investing in the stock market over the respective time periods. He suggested that a Satisfaction rating of -1 represented “perfect misery”, with 0 representing “ambivalence” and +1 representing “perfect happiness”.

The satisfaction metric takes into consideration two variables: 1) the probability of positive return and 2) the average person’s Pain Ratio of 2.5. In other words, mere positive returns were not enough to provide satisfaction, because the pain from occasional losses more than offset the pleasure from even-more-occasional gains during time periods in which the probability of losses was relatively high.

According to the table above, investing in the stock market on an hourly or daily basis resulted in satisfaction values of -0.73 and -0.71, respectively (all negative satisfaction values in pink). Negative satisfaction values imply dissatisfaction, with values near -1 approaching perfect misery. In other words, investing with a one-hour or one-day time horizon actually contributes to aggregate human misery!

In fact, stock-market investing with any time horizon of less than two years resulted in dissatisfaction!

One was able to turn dissatisfaction to satisfaction merely by investing with a time horizon of two years or more (all positive satisfaction values in yellow).

And investing with a time horizon of a decade resulted in a satisfaction rating of +0.98, or near perfect happiness (+1.0)!

Unfortunately, our degrees of satisfaction are not so easily quantified, nor will future market results or Pain Ratios mirror the past. However, all investment strategy is based on a simple optimization: We try to maximize the growth rate of our portfolios while minimizing the discomfort level in our stomachs. In my opinion, this is best executed through adherence to a solid long-term investment plan, combined with avoidance of hyper-frequent portfolio review.

By frequently looking at the market, or our portfolios, we may increase our risk aversions to unnatural levels. The more frequently we look, the more likely we observe a loss, since losses are more likely over shorter horizons (see Positive Probability column in the table above)[11]. The more often we observe a loss, the more we become concerned about future losses. The more we become concerned about future losses, the more likely our Pain Ratio becomes inflated. When our Pain Ratio becomes inflated, we are more inclined to decrease the risk in our portfolios. Unfortunately, by the time we arrive at this point in the cycle, market risks are often much reduced, because prices have already fallen. In the end, the financial risk associated with frequent market review is less wealth, due to ill-timed risk reduction and deviation from the long-term investment plan.

In summary, Benartzi, Thaler, Bernstein, and I all offer a recommendation:

To accumulate greater wealth with less upset, look at the market, and your portfolio, less often.

But if more money isn’t sufficient to shift your behavior, there is now evidence that observing stock-market volatility raises the risk of heart attacks. Of course, not all volatility is bad or stress inducing. Volatility that increases stock prices is not likely to bring on a heart attack. Instead, it’s volatility that decreases stock prices that occasionally stirs our Pain Ratios to levels that can be physically harmful. A study by Duke University researchers showed a greater number of heart-attack patients on days when the NASDAQ Composite Index was down. Another study in China indicated that a 5% decrease in the Shanghai Composite increased heart-attack risk by 17%.

To reduce the likelihood of having a heart attack, it may help to look at the market, and your portfolio, less often.

CONCLUSION

In the huge majority of cases, we monitor our portfolios over time periods of much less than the two years necessary to achieve positive satisfaction levels (in the table above). In today’s world, looking at the day’s market action is an all-too-easy distraction from a boring lunch line or a slow train ride. And after five years of front-page news being dominated by financial news, hyper-frequent monitoring is the norm and somewhat difficult to avoid.

However, it seems probable that the average result of frequent observation is bad—less wealth, more emotional pain, greater dissatisfaction, and possibly even physical harm. Our Pain Ratios are valuable to us, but only if carefully controlled.

[1] The paper was titled “Myopic Loss Aversion and the Equity Premium Puzzle” (Quarterly Journal of Economics, 1995). Several other behavioral finance papers, including some referenced by Benartzi and Thaler, found the “Pain Ratio” ranges from 2.0 to 2.5.

[2] With the majority rejecting this gamble, it implies an average Pain Ratio of greater than 2.0 (i.e., greater than 200 divided by 100).

[3] The gamble offers an expected value of $50. This is equal to 50% of -$100 plus 50% of +$200.

[4] I say “prudent” because the expected outcome of each individual gamble is a win of $50.

[5] Michael Mauboussin of Legg Mason has written a follow-up to Bernstein’s piece as well, which was very helpful.

[6] The one-year figures of 10% and 20% for the return and volatility, respectively, are the bases for the entire table. For example, the one week return is .10/52, and the one-week volatility is .20/(52^.5), while the five-year return is 1.10^5-1 and the five-year volatility is .2/(1/5^.5). The one-year figures are very close approximations of actual average results; other time periods are extrapolations of the one-year figures.

[7] From 1926 to 2011, the actual annualized return was 9.8% and the actual volatility was 20.5%.

[8] The data assume that equity market returns are normally distributed (i.e., well represented by the bell-shaped distribution, or curve). While the normal distribution has proven an unrepresentative distribution for equity market returns (at least in my opinion), I believe it remains plenty sufficient for this analysis.

[9] The calculation of Volatility/Return for the one-hour time period is 0.487/0.006 = 82.2.

[10] Over the average one-year period, there was a 69.15% probability of making money, and, necessarily, a 30.85% probability of losing money. Given those probabilities, we actually can calculate whether or not a one-year holding period provides us satisfaction, or utility, or usefulness. The calculation is as follows:

Satisfaction, or Utility = (probability of making money x 1) – (probability of losing money x 2.5); One-year utility = (.6915 x 1) – (.3085 x 2.5) = -.08

[11] Historically, this has been a statistical fact, and it is very likely to be a fact going forward as well. If investors weren’t offered a positive return on investment, at least in the long run, they would never choose to forgo current consumption.